Income Tax Rules for a salaried person

Newcomers to in Japan might experience difficult in understanding Japanese tax rules, setting up companies, or finding accountants, etc. We would like to provide some basic information regarding tax rules and related regulations about business practices for foreigners who want to start businesses in Japan. To start off, we explain what kinds of taxes are imposed to salaried people in Japan.

Case 1

<Question>

I was assigned to a subsidiary in Japan from Canada for three years, and have been working as an engineer for 6 months. On weekends I teach private English lessons. Even though a withholding tax is imposed on my salary, I do not report any information about my income from teaching English. I would like to know my tax status in the future.

<Answer>

The Japanese tax system contains separate laws for individuals and corporations. In this case, the National Income Tax is imposed. The Income Tax Law classifies tax payers into three categories:

(1) Permanent residents

(2) Non-permanent residents

(3) Non-residents

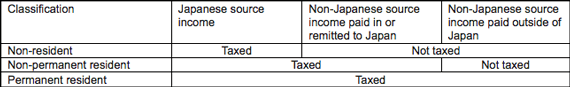

The following table is summaries of the basic tax categories for individuals.

You are categorized as a non-permanent resident, so the Income Tax is imposed in Japan. A non-permanent resident is defined as “an individual with a domicile located in Japan or who has maintained a residence in Japan continuously for one year or more up to the current date”. Consequently, you might need to pay the following taxes in Japan.

(1) Withholding tax & Income Tax

The Income Tax is assessed on income earned throughout the calendar year.

The withholding tax is a kind of advance payment of the Income Tax, and they are related to each other. The system of withholding taxes exists to collect the Income Tax from salaries paid in Japan. For employment income, the withholding tax must be paid to the tax payer’s national tax office by the 10th of the following month. This payment is adjusted by an “Annual Adjustment”. The Annual Adjustment is a process which is performed by employers at the end of year to re-calculate the Income Tax and settle it. If there is any shortage in payment, such a shortage will be withheld from the last salary payment and if there is any overpayment, such an overpayment will be adjusted by appropriating it to the tax amount to be withheld from the last salary payment or by refunding it to individual employees. If the amount of salaries and wages earned exceeds 20,000,000 yen, the year-end adjustment is not made by the employer. Accordingly individuals have to file the final return.

(2) Local tax

Individuals are subject to Local Inhabitants Tax based upon the prior year’s Income Tax. Therefore the Local Inhabitants Tax would not be imposed in the current year but following year.

(3) Other Income Tax

There are ten categories of the Income Tax. Income received from teaching English is categorized as miscellaneous income. If salaried people receive an annual miscellaneous income exceeding 200,000 yen, filing a tax return is required.

By Certified Public Accountant (CAP) & Tax Accountant, Koji Takahashi

Tokyo & Yokohama